Puduvai Bharathiar Grama Bank Personal Loan Key Features Jan 2021

| Eligibility Criteria | Details |

| Age Criteria |

For salaried 21–58 (at loan maturity) |

| For self-employed 28 to 65 | |

| CIBIL Score |

Minimum 750 or above |

| Puduvai Bharathiar Grama Bank Personal Loan Interest Rate |

9.99% per annum |

| Additional Interest on Late Repayment | 24% p.a. |

| Tenure |

12 to 60 months |

| Puduvai Bharathiar Grama Bank Personal Loan Processing Fee |

1%-2% |

| Prepayment Charges |

Bank Decision |

| Part Payment Charges |

Allowed after 12 Months (2 – 4 %) |

| Minimum Loan Amount | ₹ 50,000 |

| Maximum Loan Amount | ₹ 20 Lakh |

Each Feature Explained in Detail Below

Benefits of Puduvai Bharathiar Grama Bank Personal Loan

- First and foremost, a personal loan can be applied for online very easily.

- The personal loan in Puduvai Bharathiar Grama Bank is available at attractive interest rates and affordable EMIs.

- Personal loan Puduvai Bharathiar Grama Bank offers repayment flexibility.

- You can avail of a loan amount up to Rs. 20 lakhs. Thus, this personal loan can help you with any financial requirements.

- You can apply for Puduvai Bharathiar Grama Bank Personal loan with minimal documentation.

- The process with Dialabank is hassle-free and facile.

- Maximum 60 EMI’s

Puduvai Bharathiar Grama Bank Personal Loan Eligibility Criteria

The personal loan eligibility criteria for a personal loan are as follows:

| CIBIL score Criteria |

Minimum 750 |

| Age Criteria |

For salaried 21 –58 (at loan maturity) |

| For self-employed – 28 to 65 | |

|

Minimum Income Criteria |

For salaried – Rs. 20000 per month |

| For self-employed – Rs. 15 lakhs per year | |

|

Number of years in job/ business |

Salaried – 2 years |

| Self-employed – 5 years |

Puduvai Bharathiar Grama Bank Personal Loan Interest Rate, Fees & Other Charges

| Category | Details |

| Puduvai Bharathiar Grama Bank Personal Loan Interest Rate | 9.99% per annum |

|

Puduvai Bharathiar Grama Bank Personal Loan Processing Charges |

1%-2% |

|

Prepayment Charges |

Bank Decision |

| Stamp Duty |

As per state laws |

|

Cheque Bounce Chgs |

N/A |

|

Floating Rate of Interest |

Not Applicable |

|

Overdue EMI Interest |

Bank Decision |

Puduvai Bharathiar Grama Bank Personal Loan Overdraft Facility

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can correspondingly repay the got out absolutely at whatever point the condition is ideal. In this way, the most preferred credit decisions profited from meeting changing individual supporting necessities unbounded.

Apply for an overdraft as Puduvai Bharathiar Grama Bank Personal Loan. The flexible improvement office has all the enormous features of an unstable overdraft credit.

Puduvai Bharathiar Grama Bank Personal Loan Personal Loan Documents Required

| Particular | Document |

| Form |

Duly filled application form |

|

Proof of Identity |

Copy of Passport, |

|

Driving License, |

|

| Aadhar Card, | |

| Voter ID Card | |

|

Proof of Address |

Rent Agreement (Min. 1 year of stay) |

| Utility Bills | |

| Passport (Proof of permanent residence) | |

| Ration card | |

|

Proof of Income |

ITRs: Last two Assessment years |

| Salary Slip: Last 6 months | |

| Bank Statement: Last 3 months |

Documents Required for Salaried Applicants:

- The salaried applicant have to submit any one ID Proof such as a PAN card, driving license, passport, or a voter ID card

- Anyone Residence Proof such as a passport or recent utility bills has to be submitted.

- The salary slips for the last 3 months will be required, along with the bank statement for the last 3 months

- 2 latest passport size photographs of the applicant, colored

*NOTE: In the case of rented apartments, the rent agreement is to be attached.

Documents Required for Self-Employed Applicants:

- For self-employed applicants, KYC documents such as ID proof, residence proof, proof of date of birth have to be submitted

- The income proof will include audited financial statements for the last 2 years.

- Proof of ownership of the office or residence will be required.

- Proof of the office address should be submitted.

- The bank statements for the last 6 months should be submitted.

- Lastly, proof of continuity of business for at least 5 years should be submitted.

Personal Loan EMI Calculator for Puduvai Bharathiar Grama Bank Personal Loan Bank

Why should you apply for Puduvai Bharathiar Grama Bank Personal Loan with Dialabank?

- Our motto here at Dialabank is ‘make things simple.’

- We help bring all information related to Puduvai Bharathiar Grama Bank Personal Loan in a detailed and easy-to-understand manner.

- We don’t charge you for our services.

- We help you avail of the best features available.

- We help you apply for a Puduvai Bharathiar Grama Bank Personal Loan without any hassle through our website.

- We offer a document pick-up facility from your doorsteps.

- We offer a personalized service. Therefore, you can call us in case of any queries.

Call us at 9878981166 to avail of the Puduvai Bharathiar Grama Bank Personal Loan.

How to Calculate EMIs for Puduvai Bharathiar Grama Bank Personal Loan Bank Personal Loan

To calculate your EMIs for the Puduvai Bharathiar Grama Bank Personal Loan, just enter all the values such as the principal loan amount, tenure in months, and the rate of interest.

Enter any extra charges such as prepayment charges and processing fees.

The personal loan EMI calculator will give you the exact monthly payable amount. This will help you plan your repayment.

Pre Calculated EMI for Puduvai Bharathiar Grama Bank Personal Loan

| Loan Amount @ Rate of Interest | Tenure Of Loan | ||||

| 1 year | 2 years | 3 years | 4 years | 5 years | |

| 2.5 lakh @ 11.25% | Rs. 22,125 | Rs. 11,681 | Rs. 8,214 | Rs. 6,492 | Rs. 5,467 |

| 5 lakh @ 12% | Rs. 44,424 | Rs. 23,536 | Rs. 16,607 | Rs. 13,166 | Rs. 11,122 |

| 10 lakh @ 12.5% | Rs. 89,082 | Rs. 47,307 | Rs. 33,453 | Rs. 26,579 | Rs. 22,497 |

| 15 lakh @ 13% | Rs. 1,33,975 | Rs. 71,312 | Rs. 50,540 | Rs. 40,241 | Rs. 34,129 |

Different Offers for Puduvai Bharathiar Grama Bank Personal Loan

- Puduvai Bharathiar Grama Bank has a broad range of Personal loans.

- It offers Personal Loan to Salaried Individuals Self Employed Individuals.

- Types of loans: Education, Two Wheeler, Three Wheeler, Micro Loans, Home Loans, etc.

All of these are given below, along with the details and features.

Puduvai Bharathiar Grama Bank Personal Loan for Salaried Employees

- At attractive interest rates, Puduvai Bharathiar Grama Bank offers Personal Loan for Salaried Employees.

- For a tenure of 12-60 months, Puduvai Bharathiar Grama Bank offers these loans.

Puduvai Bharathiar Grama Bank Personal Loan for Self Employed Individuals

- Puduvai Bharathiar Grama Bank, Personal Loan for Self Employes, is a loan product offered to self-employed individuals and in need of funds.

- At attractive interest rates, the bank provides their personal loans for a tenure of 12-60 months.

- For Self Employed Individuals, more documents are required as compared to the Salaried Individuals.

Puduvai Bharathiar Grama Bank Education Loan

Puduvai Bharathiar Grama Bank offers a special loan for education. There are certain eligibility criteria for this type of loan:

- Duly fill and sign the EDUCATION LOAN application form with a photograph.

- KYC (Know Your Customer) documents.

- Salary Certificate and Form No. 16.

Puduvai Bharathiar Grama Bank Personal Loan for Government Employees

At low-interest rates, Government Employees are offered Personal Loans by Puduvai Bharathiar Grama Bank, which starts at about 11.49%. In addition, they are given special offers and quick defrayal, and the option of choosing the tenure for the loan. From the Defence personnel, No Processing Fee is charged.

Apply for this by Visiting the nearest Puduvai Bharathiar Grama Bank Loan Branch or Call us at 9878981166 to avail of Puduvai Bharathiar Grama Bank Personal Loan for Government Employees.

Puduvai Bharathiar Grama Bank Personal Loan Balance Transfer

At most competitive rates, loan transfer is availed. To lessen the burden of your loans by transferring them to Puduvai Bharathiar Grama Bank and get the lowest EMIs.

Puduvai Bharathiar Grama Bank Personal Loan Overdraft Scheme

Puduvai Bharathiar Grama Bank Personal Loan Offers an Overdraft Scheme. With this, you are provided a loan amount as an overdraft facility. It works like a Credit Card, where you can spend your Personal Loan Amount as you want anytime, anywhere. The overall loan amount will have a Credit/Loan Limit. In the Puduvai Bharathiar Grama Bank Personal Loan Overdraft facility, the bank charges interest only on the amount you withdraw/utilize.

Types of Loan by Puduvai Bharathiar Grama Bank

Home Renovation Loan

Puduvai Bharathiar Grama Bank offers home update credit for people wishing to have their homes overhauled. This individual credit will back the fundamental fixes or award the borrower to purchase new home fittings, machines, and furniture. Some key features of the Puduvai Bharathiar Grama Bank Home Renovation Loan are:

- Puduvai Bharathiar Grama Bank provides home renovation loans from Rs. 2 lakh to Rs. 500 Lakh.

- The applicant must be an Indian.

- Minimum Age: 18 yrs

- Maximum Age: 75 yrs(at loan maturity)

Holiday Loan

The Puduvai Bharathiar Grama Bank’s Holiday Loan will help you with a minor issue while designing your dream move away. The vital highlights of the Puduvai Bharathiar Grama Holiday Loan are This individual Puduvai Bharathiar Grama advance will keep up a level of outing related costs, including booking travel tickets, standing workplaces, guided visits, and so forth.

- Financing costs for event drives start at 11.25 percent p.a.

- Without a huge load of stretch cared for the position, you can do a level of up to Rs 20 Lakh.

- The quick and away from of your move away is guaranteed by made and unimportant work.

- Stimulated advancement outline and managing that is expedient credited to your record.

Fresher Funding

Puduvai Bharathiar Grama credit option is proposed to help freshers, for example, proceeding with graduated class, for instance, searching for their first work. Coming up next are some sensible features of Puduvai Bharathiar Grama Fresher Funding’s individual credit:

- Credit level of up to Rs 1.5 lakh

- Competitors must, at any rate, be 21 years of age.

- The advancement of premium for Fresher Funding relies on the up-and-comer’s profile, the cash-related record/score, competitor’s age, and district.

NRI Personal Loan

For NRIs, Puduvai Bharathiar Grama equips an individual with development, understanding the necessities and dreams of NRIs. The fundamental movement should be an Indian inhabitant, and the co-competitor NRI must be close to a relative. The Individual Loan for NRIs contains the going with features.

- Puduvai Bharathiar Grama Bank gives up individual NRI advances of up to 10 lakh with adaptable end-use pushes.

- The expense of NRI Personal Loan financing begins at 15.49 percent p.a.

- The credit requires a residency of up to three years.

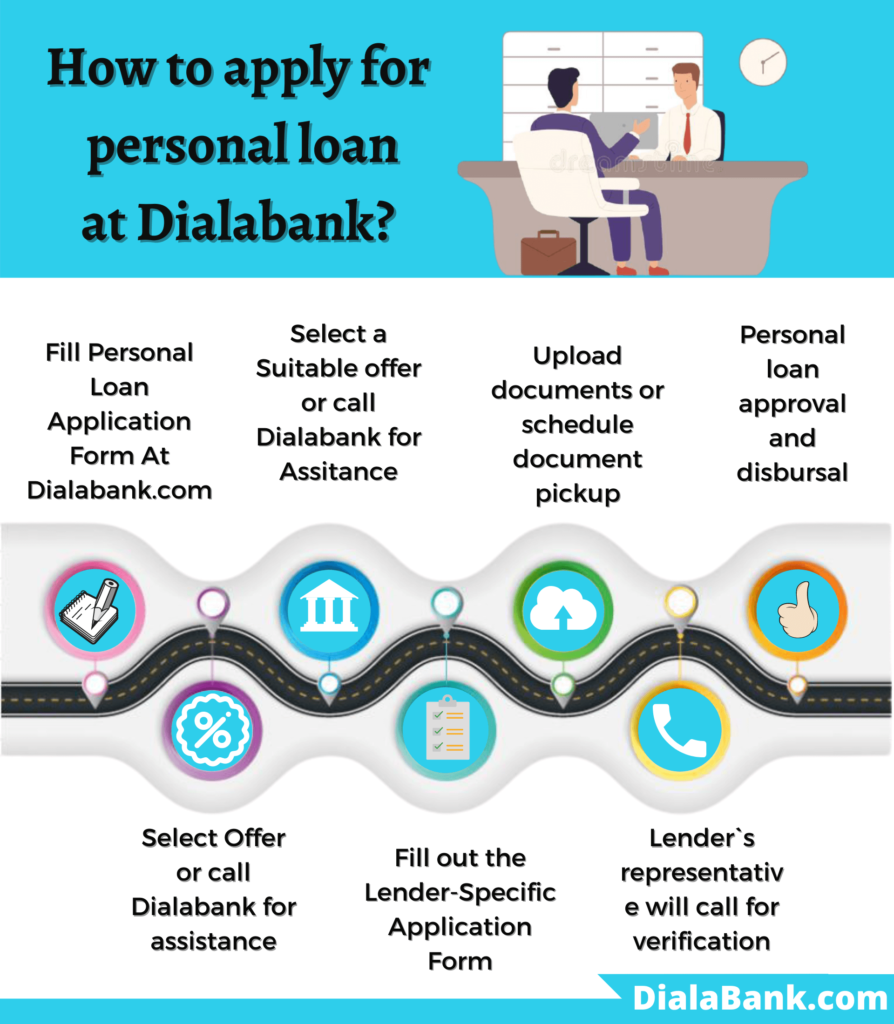

How to Apply Online for Puduvai Bharathiar Grama Bank Personal Loan?

To apply for a Puduvai Bharathiar Grama Bank Personal Loan online. To apply through Dialabank:

- Visit Dialabank.

- You can also go directly to Puduvai Bharathiar Grama Bank Personal Loan on Dialabank.

- Click on the personal loan option on the menu.

- Fill up the form with your details.

- We will shortlist offers for you and mail them to you.

- We will then call you and assist you further.

- Thus, you can avail of the best personal loan offer in record time.

Personal Loan Verification Process

The following are the means followed for check measure:

- When you complete the application method with Dialabank, your application for a Personal Loan is other than proceeded by the Bank.

- As the bank demands your application structure, they give you an accreditation call.

- When the be cautious with a telephonic conversation is done, the bank designs a get for report convenience.

- Precisely when all the basic records are connected, the further check occurs.

- As the subsequent check passes, the bank requests the last credit entire, advance expense, and the residency for the insinuated amount.

- The bank unnoticeably keeps it together for the customer’s premium, and once the customer concedes, the progression complete is promptly overseen.

- The bank inconspicuously keeps it together for the client’s interest, and once the client admits, the advancement total is immediately managed.

Puduvai Bharathiar Grama Bank Personal Loan Status

You can check the status of your Puduvai Bharathiar Grama Bank personal loan by the following methods:

- You could visit the nearest loan branch and ask the bankers also for the same.

- Log In to the bank’s net banking portal, click on the loans from the top icon and click on enquire to track the status of your personal loan.

- Search for ‘personal loan status’ on google, click on the first link, which will direct you to the loan status tracker webpage of Puduvai Bharathiar Grama Bank, and fill in the needed information to check the status of your loan.

How to login in Puduvai Bharathiar Grama Bank portal

- You can check the official website of Puduvai Bharathiar Grama Bank.

- Click on ‘Login’ in the upper right corner of the screen.

- Using your User ID and Password or reported mobile number to log in

How to Check Your Loan Statement

Clients can download the bank’s very own credit proclamation by following the means given below:

- First, visit the official site of the bank.

- Select ‘Connect,’ and from the drop-down list, choose ‘Administration Requests.’

- On the following page that opens, under the ‘Advances’ menu, click’ Individual Loan Related.’

- Tap on ‘Request for Loan Account Statement’ first.

- Log in using your User ID and the secret word or using your enlisted versatile number and OTP to benefit from the bank’s very own credit clarification.

Puduvai Bharathiar Grama Bank Personal Loan Restructuring (COVID-19)

While there was cross-country lockdown, unreasonably influenced a few borrowers by morals of the COVID-19 pandemic, and a multi-month denying on various term drives was given to control its impact on a particular degree. Puduvai Bharathiar Grama Bank communicated the RBI-guided one-time advantage by the individual credit improvement of Puduvai Bharathiar Grama Bank after the half-year boycott had wrapped up. This instrument is depended upon to offer help to those borrowers who, considering the pushing cash-related troubles of the pandemic, are not yet set up to start reimbursement of their standard EMI.

The credit target plan of Puduvai Bharathiar Grama Bank proposes an extra boycott of up to two years or a development of the current repayment term to diminish EMI pulls out from month to month. As an enormous concern, it is head that the recovery of your individual development from Puduvai Bharathiar Grama Bank will accomplish extra amazing charges far past those of the standard improvement. However, as necessities are, if whatever else fizzles with the craving for not winding up defaulting on your unprecedented credit, you can, on an essential level, utilize this help instrument.

Puduvai Bharathiar Grama Bank Customer Care

Customers can contact Puduvai Bharathiar Grama Bank customer care via any of the following means:

- By Phone: You can call Puduvai Bharathiar Grama Bank on 9878981166 (toll-free)

- Callback Request: You can also request a call back by visiting the bank’s website

- Online Chatbot: You can also get your queries answered by the iPal chatbot online

- Branch Visit: You can visit the nearby Puduvai Bharathiar Grama Bank branch to get your queries.

Benefits of Applying for Personal Loan on Dialabank

There are several points of concern when applying for a personal advance on the Dialabank website. Underneath some of them are provided:

- 24 x 7 Availability: At whatever point and anyplace you can get to the site of Dialabank, and thusly, when your home or office is agreeable, apply for individual development.

- Various moneylenders: com engages you to get singular credit offers from different planned advance experts on a single stage. Along these lines, it wipes out the need to visit distinctive bank locales or branches.

- Know EMI: On the EMI calculator, you can check the EMIs you would be paying on an individual credit even before you apply for one. It will help you get the reasonable total that you can without a very remarkable stretch repay and have a supportive repayment plan.

- Free Help: Additionally, you are not supposed to pay any charges when you apply for an individual advance on Dialabank.com

Important Aspects

Below are some critical points you ought to consider while applying for an individual Puduvai Bharathiar Grama Bank credit:

- It is ideal for checking your Credit-related evaluation in any condition while applying for an individual new unforeseen new development. The odds of your credit keep up are worked by a solid credit appraisal and can permit you to profit by an individual advancement on better concordance.

- Before picking a particular bank, it is adroit at considering the expense of an individual credit (premium cost and every reasonable cost and charge) offered by various moneylenders on Dialabank.com.

- Secure as appeared by the need and repayment limit. Make the essential advances not to win since you’re set up to get a higher aggregate. It just adds to the cost of your kept up position and has a reasonably couple of central great lights as time goes on.

- Make the focal advances not to apply all the while with different moneylenders for express advances. This shows that you are ready for credit and broadens the level of complex credit report rules, which can strangely impact your FICO score.

FAQs About Puduvai Bharathiar Grama Bank Personal Loan

✅ What is Puduvai Bharathiar Grama Bank Personal Loan?

A Personal Loan is a loaning plan that can be availed to meet your urgent financial needs without submitting security to the bank.

✅ What is the Personal Loan rate of interest in Puduvai Bharathiar Grama Bank?

The personal loan rate of interest in Puduvai Bharathiar Grama Bank is 9.99% per annum.

You can visit Dialabank’s online portal to compare the different rates of other banks and finance companies across India.

✅ How can I get Puduvai Bharathiar Grama Bank Personal Loan?

To get a Personal Loan, you will have to visit the nearest branch with basic KYC documents, PAN card, and income proofs(salary slips, bank statement).

You can also contact Dialabank to avail of the best financial advice.

✅ How to apply for a Personal Loan in Puduvai Bharathiar Grama Bank?

Apply for a Personal Loan by walking into the nearest Puduvai Bharathiar Grama Bank branch with all the requisite documents.

You can also apply online with Dialabank and avail of personalized assistance for all your financial needs.

✅ Why apply for Puduvai Bharathiar Grama Bank Personal Loan?

Puduvai Bharathiar Grama Bank Personal Loans can be used for any personal financial needs.

You do not need to provide any collateral security in exchange for your loan, and the repayment can be made in monthly installments, EMIs.

✅ How much EMI on Puduvai Bharathiar Grama Bank Personal Loan?

Calculate your Puduvai Bharathiar Grama Bank Personal Loan EMI using your loan tenure, loan amount, and interest rate on Dialabank’s EMI calculator and apply for all your loan needs with us.

✅ How much is the CIBIL score required for Puduvai Bharathiar Grama Bank Personal Loan?

Puduvai Bharathiar Grama Bank prefers a CIBIL score above 700 to disburse a Personal Loan.

✅ Minimum credit score needed for Puduvai Bharathiar Grama Bank Personal Loan?

Puduvai Bharathiar Grama Bank requires you to have a credit score of at least 750 to consider your loan application for approval.

✅ How to calculate Puduvai Bharathiar Grama Bank Personal Loan EMI?

Use your loan amount, loan tenure, and interest rate to calculate your Personal Loan EMI using the EMI calculator, which is available on Dialabank’s website.

✅ What can I use Puduvai Bharathiar Grama Bank Personal Loan for?

You can use your Puduvai Bharathiar Grama Bank Personal Loan for various financial needs such as funding for your marriage or that of a relative, paying all your bills, renovating, refurbishing, or repairing your home, etc.

✅ Can I prepay Puduvai Bharathiar Grama Bank Personal Loan?

If you have the required funds, you can pre-close your loan by visiting the Puduvai Bharathiar Grama Bank branch, from where your loan was approved, and ask your banker about the prepayment facilities.

✅ How to prepay Puduvai Bharathiar Grama Bank Personal Loan?

When you have the required money and feel the need to close your loan at once, just visit the nearest Puduvai Bharathiar Grama Bank branch with your loan documents and apply for a foreclosure.

You may be asked to pay a small foreclosure fee in addition to your outstanding loan amount.

✅ How to repay Puduvai Bharathiar Grama Bank Personal Loan?

Repay your Personal Loan in easy burden-free EMIs that are automatically deducted from your bank account each month. Your Puduvai Bharathiar Grama Bank Personal Loan can be repaid through post-dated cheques too.

✅ What documents are needed for Puduvai Bharathiar Grama Bank Personal Loan?

Aadhar Card/Voter ID, PAN Card, Salary Slips, Bank Statement, and ITR File are the documents that are required to avail of a Personal Loan from Puduvai Bharathiar Grama Bank.

✅ How to check Puduvai Bharathiar Grama Bank Personal Loan status?

Visit your loan branch or contact the customer care number of Puduvai Bharathiar Grama Bank to know your loan application status and stay updated.

✅ What is the Processing Fee for Puduvai Bharathiar Grama Bank Personal loan?

The processing fee is up to 1%-2%.

✅ What is Puduvai Bharathiar Grama Bank Personal Loan maximum tenure?

Puduvai Bharathiar Grama Bank Personal loan maximum tenure is 60 months.

✅ What is Puduvai Bharathiar Grama Bank Personal Loan minimum tenure?

Puduvai Bharathiar Grama Bank Personal Loan minimum tenure is 12 months.

✅ What is the Puduvai Bharathiar Grama Bank Personal Loan customer care number?

The customers get in touch with the bank via call on 9878981166.

✅What are the Puduvai Bharathiar Grama bank Personal Loan pre-closure charges?

If you want to apply for foreclosure, contact the bank or visit there to know the charges and documents.

✅What is the Puduvai Bharathiar Grama bank Personal Loan closure procedure?

- Visit the bank with the complete set of documents (as mentioned above).

- You may be required to fill a form or write a letter requesting the Personal Loan account pre-closure.

- Pay the pre-closure amount.

- Sign the required documents, if any.

- Take acknowledgment of the balance amount you have paid.

✅What is the Puduvai Bharathiar Grama Bank Personal Loan Overdraft Facility?

An individual overdraft is a credit office that licenses you to pull out an all-out as and when required. You can correspondingly repay the got out absolutely at whatever point the condition is ideal. In this way, the most preferred credit decisions profited from meeting changing individual supporting necessities unbounded.

Other Banks For Personal Loan

| Telangana Bank Personal Loan | |

| Telangana Grameena Bank Personal Loan | |

| Suryoday Small Finance Bank Personal Loan | |

| State Bank of Hyderabad Personal Loan |