|

Feature

|

HDFC Bank

|

Private Bank

|

Kotak Mahindra Bank

|

|

Interest Rate

|

8% - 8.4 %

|

8.5 - 9.5 %

|

11%

|

|

Min Loan Amt

|

Metro : 1 Lac & Non Metro: 75000

|

75000

|

75000

|

|

Max Loan Amt

|

1 Cr

|

1 Cr

|

1 Cr

|

|

Loan Tenure

|

Upto 7 Years

|

Upto 5 Years

|

Upto 5 Years

|

|

Processing Fee

|

1999 - 4999 + Tax

|

0.25% to 1.50%

|

0.25% to 1.50%

|

|

Preclosure Chgs

|

2%, Nil after 24 months

|

2%, Nil after 36 months

|

Nil

|

|

Loan to Value (LTV)

|

Upto 100% on Ex- showroom

|

Upto 95% on Ex- showroom

|

Upto 90% on Ex- showroom

|

Features of Two Wheeler Loan in Allahabad

A bike often becomes an essential vehicle when it is about meeting quick requirements. To help you in buying a bike, the cheap Two Wheeler Loan will play a vital role. This loan provides the essential fund, for buying a motorbike, along with favourable and convenient terms and conditions.

- Affordable

- Simple and Hassle-free

- Easy to payback

- Flexibility of payment

- Speedy Approval in 4 hours

- Minimum Documentation

- Attractive Interest Rates

|

Bank

|

Processing Fee

|

Prepayment Charges

|

|

HDFC Bank Car Loan

|

(1999 - 4999) + Tax

|

2%, Nil foreclosure charges after 24 months

|

|

Axis Bank Car Loan

|

1 % to 2.50%

|

Nil

|

|

Private Bank Car Loan

|

0.25% to 1.50%

|

2%, Nil foreclosure charges after 36 months

|

|

SBI Car Loan

|

500/- to 0.50%

|

Nil

|

|

Kotak Car Loan

|

1% to 2%

|

2.25% of foreclosure amount if closed 1 month ahead of the tenure.

|

|

IIFL Car Loan

|

Nil

|

Nil

|

|

Muthoot Car Loan

|

Nil

|

Nil

|

|

Manappauram Car Loan

|

Nil

|

Nil

|

|

PNB Car Loan

|

0.70% to 1%

|

Nil

|

|

Canara Bank Car Loan

|

1%

|

Nil

|

|

Andhra Bank Car Loan

|

Nil

|

Nil

|

Know More – Two-wheeler Loan interest rate

Two Wheeler Loan Allahabad Documents Required

Documents required for a two-wheeler loan are as followed:

For Salaried:-

- Address Proof: Driving license / Voters card / Passport Copy / Aadhaar Card

- Identity Proof: Aadhaar Card, Voters ID card, Passport, Driving License

- Compulsory Documents: PAN Card

- Bank Statement: Last 3 months.

For Self Employed:-

- Identity Proof: PAN Card, Voters ID card, Passport copy, Driving License

- Bank Statement: Last 3 months.

- Address Proof: Voters card / Passport Copy / Driving license / Aadhaar Card

- Required Documents: PAN Card

Two Wheeler Loan Allahabad Eligibility Criteria

The two-wheeler loan eligibility requirements are as followed:

Your ability to repay the loan is the biggest factor in deciding whether you’ll be eligible or not for the two-wheeler loan. The following are the major criteria’s:- The borrower should be at least age 21 and a maximum age 65 to qualify for the loan.

- You are eligible for the two Wheeler loans if you have an average monthly income of Rs 7000 (salaried) and Rs 6000 (self-employed)

Two Wheeler Loan for Top Selling Bikes in Allahabad

Processing Fees / Prepayment Charges on Two Wheeler Loan in Allahabad

Processing Fees– Up to 3% of the loan amount (maximum)

Pre-payment charges- Within 4 to 6 months – 10% of principal outstanding Within 7 to 12 months – 6% of the outstanding principal 13-24 months – 5% of principal outstanding Post 24 months – 3% of the key outstanding Prepayment within three months of EMI repayment is not permitted.Car Loan Allahabad Contact Number

In case of any queries regarding the two-wheeler loan in Allahabad, you may contact on the number 9878981166 for any sort of assistance. Visit Dialabank to know more.

Pre Calculated EMI Table for Two Wheeler Loan Allahabad

| Rate | 4 yrs | 3 yrs | 2 yrs | 1 yr |

| 11.83% | 2625 | 3313 | 4699 | 8876 |

| 12.00% | 2633 | 3321 | 4707 | 8884 |

| 12.50% | 2658 | 3345 | 4730 | 8908 |

| 13.00% | 2682 | 3369 | 4754 | 8931 |

| 13.50% | 2707 | 3393 | 4777 | 8955 |

| 14.00% | 2732 | 3417 | 4801 | 8978 |

| 14.50% | 2757 | 3442 | 4824 | 9002 |

| 15.00% | 2783 | 3466 | 4848 | 9025 |

| 15.50% | 2808 | 3491 | 4872 | 9049 |

| 16.00% | 2834 | 3515 | 4896 | 9073 |

| 16.50% | 2859 | 3540 | 4920 | 9096 |

| 17.00% | 2885 | 3565 | 4944 | 9120 |

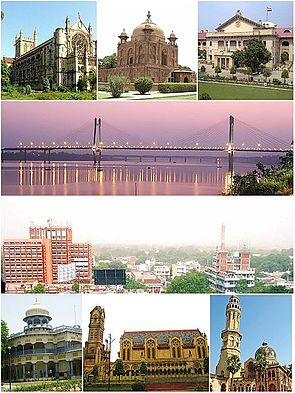

About Allahabad

Two Wheeler Loan EMI Calculator Allahabad