Form 16 – How to Download & fill Form No 16A, Form 16B

What is Form 16?

Each individual acquiring a month to month pay is qualified for getting Form 16 from his/her manager. On the off chance that you are a salaried individual, you would get Form 16 from your manager before 31st May 2021. Structure 16 is authentication that affirms that TDS has been deducted from your compensation by your boss and furnishes you with all the data needed for documenting your Income Tax return.

GOLD LOAN @ 0.75%*

APPLY NOW

Different Parts of Form 16

| Parts | Description |

|---|---|

| Part A | Details of TDS deducted on income |

| Part B | Details of components of salary, tax due, tax paid |

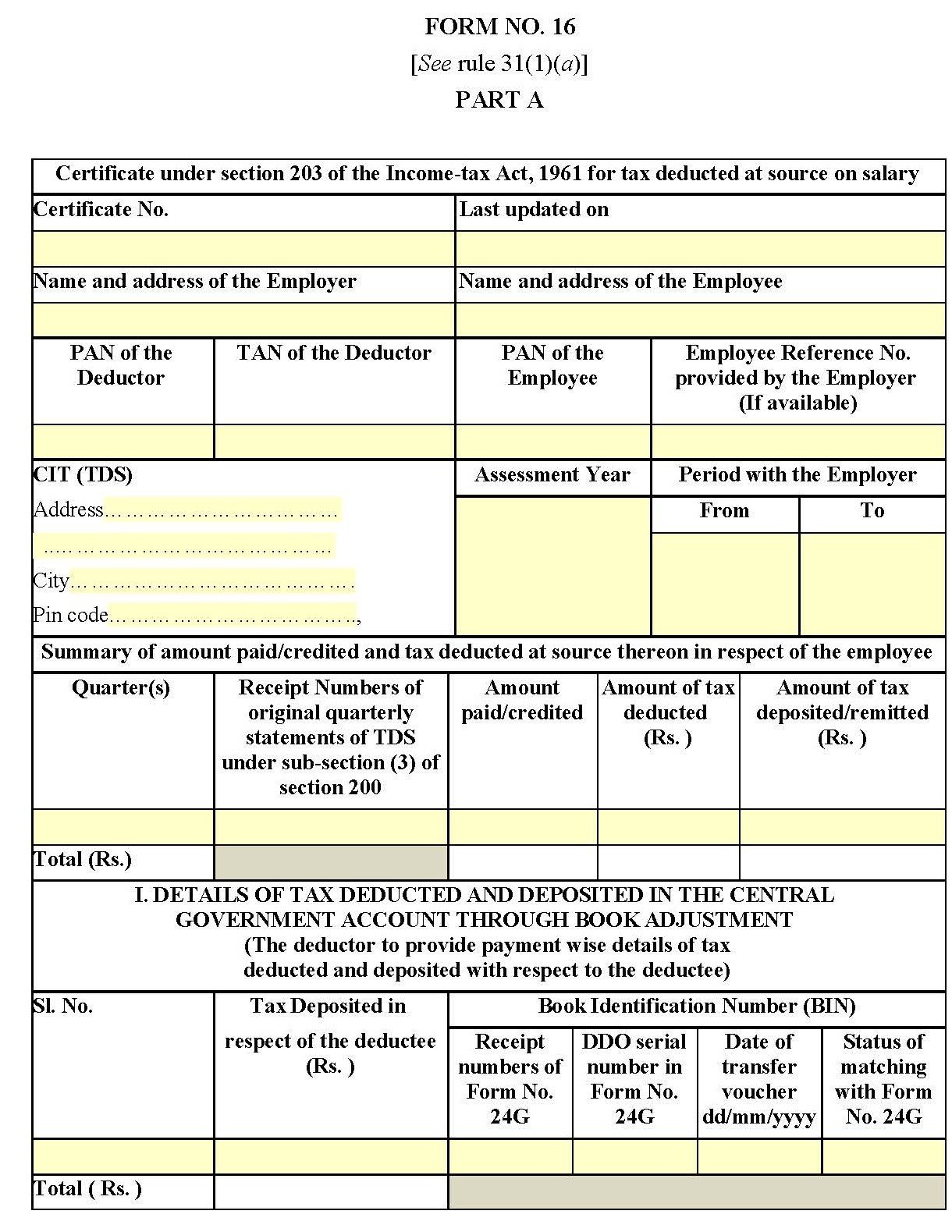

PART A of Form 16, 2021

Part A of Form 16 gives the sum and subtleties of assessment deducted from your pay and kept to the public authority according to a month to month and quarterly TDS recorded by your boss. It incorporates:

- Your own subtleties like name, address and PAN number

- Subtleties of your manager like the name of the firm, TAN number and PAN of your boss

- The measure of TDS deducted and stored quarterly alongside different subtleties including date of store, BSR code of the bank office through which duty is saved, challan chronic number identifying with each measure of assessment saved by your boss

- Evaluation year

- Your time off work with the current boss

GOLD LOAN @ 0.75%*

APPLY NOW

How to Download Form 16 Part A

Employers can generate and download Part A of Form 16 by following the below-mentioned procedure.

- First and foremost, visit the entrance of TRACES by tapping on https://www.tdscpc.gov.in/application/login.xhtml.

- Presently, sign in to the entryway utilizing your login ID and secret word.

- Under the downloads tab, you can discover Form 16 A.

- At last, fill in the necessary subtleties. It contains the accompanying information.

- Name and Address of the Employer.

- Name and Address of the Employee.

- PAN and TAN of the deductor/manager.

- PAN of Employee.

- Sum paid/credited.

- Assessment deducted at source.

GOLD LOAN @ 0.75%*

APPLY NOW

PART B of Form No. 16, 2021

Part B is an annexure to Form 16 which incorporates subtleties and segments of compensation paid, tax due, and tax paid. It is a nitty-gritty calculation and a methodical record of your taxable compensation after permitted allowances and exclusions. Form 16 Part B incorporates the accompanying information:

- Net Salary is broken into parts like essential compensation, Dearness Allowance, HRA, Medical stipends, fortunate asset commitment by both business and worker, leave travel concession, proficient tax (assuming any), transport recompense, and others

- Excluded stipends under segment 10 of the annual tax act, for example, transport remittance, house lease recompense, youngsters stipend, clinical stipend, and so on

- Derivations permitted under section VI An of Income Tax Act

- Alleviation under segment 89 of the Income Tax Act

- The measure of tax due or paid on income

- The form will likewise grandstand the measure of tax discount if overabundance tax has been paid.

Why is Form 16 needed?

- Form 16 is a nitty-gritty record of your compensation and tax paid by your boss. You require Form 16 at the hour of recording income tax return.

- Form 16 is likewise acknowledged as income evidence in different exchanges, for example, advance preparing.

- Form 16 can likewise be utilized to check whether the right taxes have been stored with the public authority account by contrasting the equivalent and your Form 26AS.

GOLD LOAN @ 0.75%*

APPLY NOW

Form 16 Eligibility

According to the guidelines by the Indian government, each salaried person inside the taxable income section is qualified for Form 16. In this way, if your absolute gross income surpasses ₹ 2.50 Lakh, your manager is under a commitment to give Form 16.

Workers or people whose income is not exactly ₹ 2.50 Lakh are excluded from income tax; consequently, no tax is deducted; thus, no Form 16 is given. In any case, bosses have begun to give Form 16 independent of the income in the present time. It is a combined verification of worker’s profit and can be utilized as essential reports in different territories.

What happens if Form 16 is not available?

On the off chance that you have not gotten Form 16 from your boss, you can allude to your Form 26AS accessible on the web. Form 26AS contains the insights regarding the tax deducted from your compensation and saved with the public authority. Nonetheless, you ought to likewise ask for and guarantee that your boss issues Form 16 to you.

Form 16 precautionary measures while recording income tax return

- All pages of Form 16 Part An unquestionable requirement be endorsed by the business either carefully or physically.

- Form 16 is produced by the Income Tax department when a business fills the subtleties of a worker like his gross compensation, derivations, and stipends according to the information outfitted by a representative. Boss issues Form 16 to the workers once in an evaluation year.

- In the event that you have worked for more than one boss, you are needed to gather Form 16 from every one of your managers as the equivalent would be needed at the hour of filing your Income Tax return.

GOLD LOAN @ 0.75%*

APPLY NOW

What is Form 16A and Form 16B?

Form 16 is an important document when you are filing the income tax return. Its two crucial components are Form 16A and Form 16B. Let’s dive deeper into each of these forms.

Form 16A

Form 16A is an endorsement catching subtleties of TDS deducted on income other than pay. TDS on pay rates is deducted at a normal income tax section as assessed dependent on the income of the representative, while TDS on income from different sources, for example, premium income, lease, and so on is deducted at the rate determined by the public authority. Form 16A is given by the deductor within 15 days after the quarter closes. For instance, for the December quarter of 2016, Form 16A will be given before the fifteenth of January 2017.

Form 16A is given by the deductor that could be your bank or your boss or some other deductor. Form 16 An is given by the bank when TDS is deducted from your income in regard to revenue on FD, protection commission, lease receipts, or some other income procured. TDS derived on different installments are likewise reflected in Form 16A.

Components of Form 16A

- Name and address of the deductor

- TAN and PAN number of the deductor

- Name and address of deductee

- PAN of deductee

- Nature of installment, the sum paid, and date of installment

- The receipt number of the TDS installment

- Challan subtleties of TDS saved

GOLD LOAN @ 0.75%*

APPLY NOW

Form 16B

Form 16B incorporates the detailed information of the calculation of tax after taking into consideration the ventures declared by you at the start of the year and the confirmation of different speculations made during the financial year.

Form 16B also incorporates detailed information about all those allowances that may be necessary to calculate your tax along with different details like medical bills, house leases, donations as outfitted by you to the business.

Components of Form 16B

- Part B of Form 16 is an Annexure to Part An and incorporates the accompanying information.

- Break up of Salary.

- Any other Income declared by the representative.

- All allowances under Chapter VI-A.

- Help under Section 89.

- Tax deducted at source.

- The overall gain tax is payable/refundable.

Difference Between Form 16, Form 16A and Form 16B

Form 16, 16A, and 16B are all certificates of tax deducted at the source. The major distinction between the three is the individual giving these certificates.

Form 16: It is given by the business and incorporates information about the tax deducted by them on the income from salary after taking into account the allowances and ventures declared by you along with its verification.

Form 16A: It is given by the financial foundations, substances, and individuals who have deducted tax at source on account of your income arising other than salary. For instance, income earned from revenue on savings or fixed store, income from lease, and so on

Form 16B: It is given to account for tax deducted at source on the income earned from the sale of immovable property. According to the Income Tax Act, it is mandatory for the purchaser of immovable property to deduct TDS of 1% on the sale value and submit it to the Income Tax Department. Form 16B fills in as proof that the purchaser has kept the tax.

GOLD LOAN @ 0.75%*

APPLY NOW

Benefits of Form 16

Form 16 is proof that the business has kept the tax deducted at source and has not submitted any fraud. In addition, it also has various different advantages like it is considered as an ‘income from salary’ statement. Other than Form 16 is demanded by various government authorities and companies on demand, for example:

- Visa issuance.

- At the hour of changing positions, it turns into a base for the following boss to calculate your tax liabilities.

- It is an income confirmation.

- A report to check for any overpaid taxes.

- It helps in recording income tax returns.

- Single report to check all your tax-saving ventures.

- For loan assessment and approval.

How to get Form 16?

Form 16 is given by the business to the worker as proof of tax deducted at the source. It is mandatory for the business to give Form 16 for the TDS deducted on salaries.

Businesses can either give a print duplicate of Form 16 to their workers or in delicate duplicate to be downloaded from the business’ account on the TRACES site. A few bosses also control their workers to any reevaluated online platform for payroll. You can always ask for a duplicate of Form 16 in case you have misplaced the original one.

To get the previous year’s Form 16 you can either ask your boss or keep an eye on the business’ re-appropriated payroll platform.

To get Form 16A, you need to ask the financial organization to issue you the form. You can also download it from your account in case it’s available. For TDS on income from lease, you need to ask your tenant to give you Form 16A, while you need to ask your manager in the event that you have filled in as a commission agent.

To get Form 16B, you need to ask the purchaser of your immovable property to give you the form.

GOLD LOAN @ 0.75%*

APPLY NOW

Filing Income Tax Returns with Form 16

Form 16 is an important record during the time spent documenting IT return. Any individual whose income is ₹ 5 Lakh each year is mandatory to document the return on the web. You can document your return without anyone else or take the assistance of a Chartered Accountant or any outsider service provider.

After recording your return on the web, you need to re-confirm it by generating e-verification code utilizing:

- Aadhaar card OTP

- Demat Account

- Net banking

- By generating EVC

Required Details of Form 16 while Filing Income Tax Return

To file your Income Tax Return, you would be required to fill in the following details:

GOLD LOAN @ 0.75%*

APPLY NOW

FAQs

✅ How do I get Form 16?

You can get Form 16 either from your employer or through the online payroll service provider.

✅ Can we download Form 16?

Form 16 is not available for download from the TRACES account of an employee. Thus, it can only be downloaded by the employer.

✅ Is Form 16 mandatory for all employees?

It is mandatory for employers to issue Form 16 to all those employees whose annual income exceeds ₹ 2.50 Lakh.

✅ What is Form 16 Part A and B?

Form 16 is divided into two halves, Part A and Part B. Part A of Form 16 includes details of employee and employer:

On the other hand, Part B of Form 16 includes:

✅ What is the difference between Form 16 and 16a?

Form 16 is the certificate of TDS deducted from salary. It is sub-categorized into Part A, which includes employer and employee details, and Part B, which includes other details like deductions, details of salary paid, tax payable, etc.

On the other hand, Form 16a is the certificate of TDS deducted on income other than salary like interest from fixed deposit, TDS on rent, etc.

✅ Is Form 16a mandatory for ITR?

Yes, Form 16, 16A, and 16B are mandatory for filing ITR.

Contact Dialabank for future details on Form 16.