What is GST Number Check?

This is also known as a GST number or a GST ID. As a result of the introduction of GST, every registered person has been given a 15-digit unique identity number based on their PAN number. Becoming a tax-registered merchant, you may want to verify your GST Number (GSTIN) before submitting it in your GST Returns.

This is also known as a GST number or a GST ID. As a result of the introduction of GST, every registered person has been given a 15-digit unique identity number based on their PAN number. Becoming a tax-registered merchant, you may want to verify your GST Number (GSTIN) before submitting it in your GST Returns.

An individual who is an assessee under the Income Tax Act can have numerous GSTINs, one for each state or union territory in which they operate. When a person crosses the threshold for GST registration by registering himself, obtaining a GSTIN becomes mandatory.

GOLD LOAN @ 0.75%*

APPLY NOW

Format of the GST Identifier

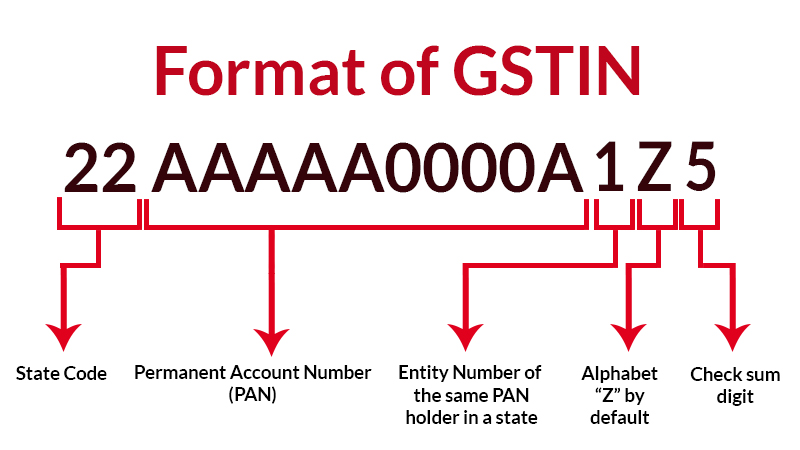

GSTIN consists of the following components:

- 1st 2 digits = State code of the registrant.

- The following 10 characters are the PAN of the registered individual.

- 1 digit represents an entity code.

- 1 digit is left blank for future use.

- The last digit is Check code is an alphanumeric or numeric code that is used to detect mistakes.

What is the GST Number Search Tool, and how does it work?

It’s easy to verify a GSTIN by using GST Number Search Tool and GSTIN Validator. Anyone can utilize this function for free, as long as they have their GSTIN on hand.

GST Number Search Tool and GSTIN Validator – How to Use?

There’s only one thing to do:

- Fill up the search box below with a valid GSTIN number

- Click on the “Search” button to start your search

- It is possible to verify the following facts here if the GSTIN is correct

- Its official name and the state where it was registered

- The company, sole-proprietorship, or partnership structure

- Regular taxpayer or composition dealer

- Taxpayer Identification Number (TIN) Status

Tax Identification Number (GSTIN) Search & Verification Tool

GSTIN Validator provides the following benefits when verifying a GSTIN:

- To verify the authenticity of any GSTIN number.

- An invoice’s GSTIN can be checked if it’s uncertain.

- Vendors who use fraudulent GSTINs can be prevented from doing business with you.

- GSTIN fraud can be prevented.

GOLD LOAN @ 0.75%*

APPLY NOW

What is the purpose of the GSTIN number?

GSTIN is a requirement for launching a business. According to the GST law, a registered individual’s GSTIN must be displayed at their business locations. In addition, you have to include it in your invoices, e-way bills, GST returns and any other information you submit to the tax authorities, among other things.

How to get GST Identification Number?

A GSTIN can be obtained by submitting the GST REG-01 and the relevant documentation via the GST portal. The form must be filled out completely. A GSTIN will be assigned to the applicant after an authority completes the verification.

Get GST Numbers by searching your name.

It is easy to find the GST number by typing in a company’s name or using its initials to search. Using the techniques listed below, you can find a GST number by name.

- You must enter a valid business name.

- Enter at least 10 characters to find out the GST number of the relevant business.

- When searching for an answer, be sure to include the State’s initials and business characters.

GST Number Check by PAN

- GST number or GSTIN of a firm can’t be searched with a PAN number because there is no such feature supplied by the country’s Tax department currently.

- A GST number’s first two digits are used to represent a state’s tax identification number. The next 10 digits represent a PAN number, and the 13th digit is usually the 1st.

GOLD LOAN @ 0.75%*

APPLY NOW

FAQs About GST Number Check

✅ When will a GSTIN be allocated?

The GST portal will assign a 15-digit GSTIN to the applicant once the GST registration application has been approved.

✅ Is it compulsory to include GSTIN on the invoice?

Yes, a taxpayer’s GSTIN must be included on all invoices. The GST registered person should also show the GST registration certificate at all places of business.

✅ Can I have more than one GSTIN?

Businesses that operate in more than one state can register for GST separately in each state. For example, in a textile company selling in Telangana and Delhi, the company must file for GST registration in each state separately.